A. The Problem

There has been concerns lately around the sustainability of Anchor's 20% flat interest rate, especially with the Anchor yield reserve.

Responses from the Anchor team were as follows:

- Withdraw funds from the Terra Stability Reserve to temporarily hold Anchor's 20% interest rate.

- Back it with a $1.5B Bitcoin reserve.

- Adopt a semi-dynamic interest rate model that depends on the yield reserve's depletion rate.

While the BTC reserve swap mechanism that mimics the Luna to UST virtual swap pool is quite clever (as this is not a synthetic swap anymore), it is fairly clear that a fixed income product with 20% yield is not sustainable in the long term.

Yield that depositors receive comes from interest that borrowers pay – if interest rates are high, that means someone needs to pay for it. That is the reason why higher interest rates decrease available liquidity and increase costs of leverage, acting as an immediate defense against inflation.

Anchor's answer to that was interest-bearing collateral, namely staking derivatives; recall that the original proposal for Anchor was principle protected staking, i.e. allowing staking yield to be given out to stablecoin depositors without the risk of price fluctuation for proof-of-stake assets.

However, there was still one question remaining: if the collateral itself is yield-bearing, why would anyone holding them borrow stablecoins with it and pay so much for a borrow position that one can do much cheaper already on existing money market protocols like Compound or Aave?

Giving up staking yield on staking derivatives and paying borrow interest on top of it doesn't make much sense.

The immediate answer to this was the ANC token: emit more ANC tokens to borrowers when the yield reserve is running low, and emit less when the yield reserve holds enough stablecoins. Control ANC liquidity by buying back ANC tokens with a portion of Anchor's yield and distributing to stakers.

Unfortunately, while the protocol itself was a huge success, its token didn't do as well and also failed to meet its purpose of bootstrapping borrow demand.

To reiterate the problem statement here: Anchor needs to justify why people would borrow stablecoins at such a high interest rate, otherwise the protocol will not last.

B. A Quick Intro to Hedging, Option Vaults, and Nonfungible Synthetic Assets

An immediate solution that comes to mind is hedging. In short, hedging strategies combine two or more high-risk ounterpositions to reduce risk and maximize returns.

But combine what positions exactly?

Let's look at the list of collateral available for borrowing UST on Anchor: bLuna, bETH, and sAVAX.

If you borrow stablecoins with any one of those collateral types, you are effectively longing that collateral (or, to be precise, a type of collateral that is one-to-one pegged to its underlying staked asset) as you get liquidated when its value plummets.

This means the obvious first step to hedging those borrow positions would be to short the underlying collateral.

Looking at bETH first, assuming that bETH holds its peg against ETH, we can take another financial primative on Terra that is long forgotten: Mirror mETH.

Why is this an ETH short? You get liquidated when ETH prices are higher, because you would need more UST to cover the said CDP (collateralized debt position).

If you immediately provide liquidity to Terraswap for farming MIR, then you would be shorting ETH and earning yield from there as well – unlike the name "long farm" (albeit at a different hedging capital efficiency, of which we will discuss later).

bLuna is a bit trickier because there is no mLuna to short it, but we can create an equivalent short position. Ironically that short position is a Luna call option, executed at a lower value range.

How so? Assume that Luna got absolutely rekt, and your borrow position is now close to liquidation – let's play safe here, however, and execute this when LTV is higher than some conservatively set value. Now what we can do is to exercise the Luna call option and buy more Luna with provided UST with a call option vault, which is then used to provide more collateral and lower LTV.

When LTV (or, under my proposal, a time-weighted valuation of all collateral types combined) is lower than some given margin, we withdraw bLuna and liquidate it back to UST, eventually providing that to the Luna call option vault.

So as long as you have the right option vault type to combine with a borrow position, you can hedge it to significantly reduce risk, at least in theory. For bLuna, a call option vault is used to buy Luna at a lower value; for bETH, we can either use Mirror or an ETH call option vault, depending on relative capital efficiency for each.

There is one missing puzzle piece here, however: hedge against what?

Some people prefer HODLing ETH or Luna, others prefer holding their assets in stablecoins. Therefore, even if we have the exact same hedging strategy, a long position for some may be a short for others – which is not what we want.

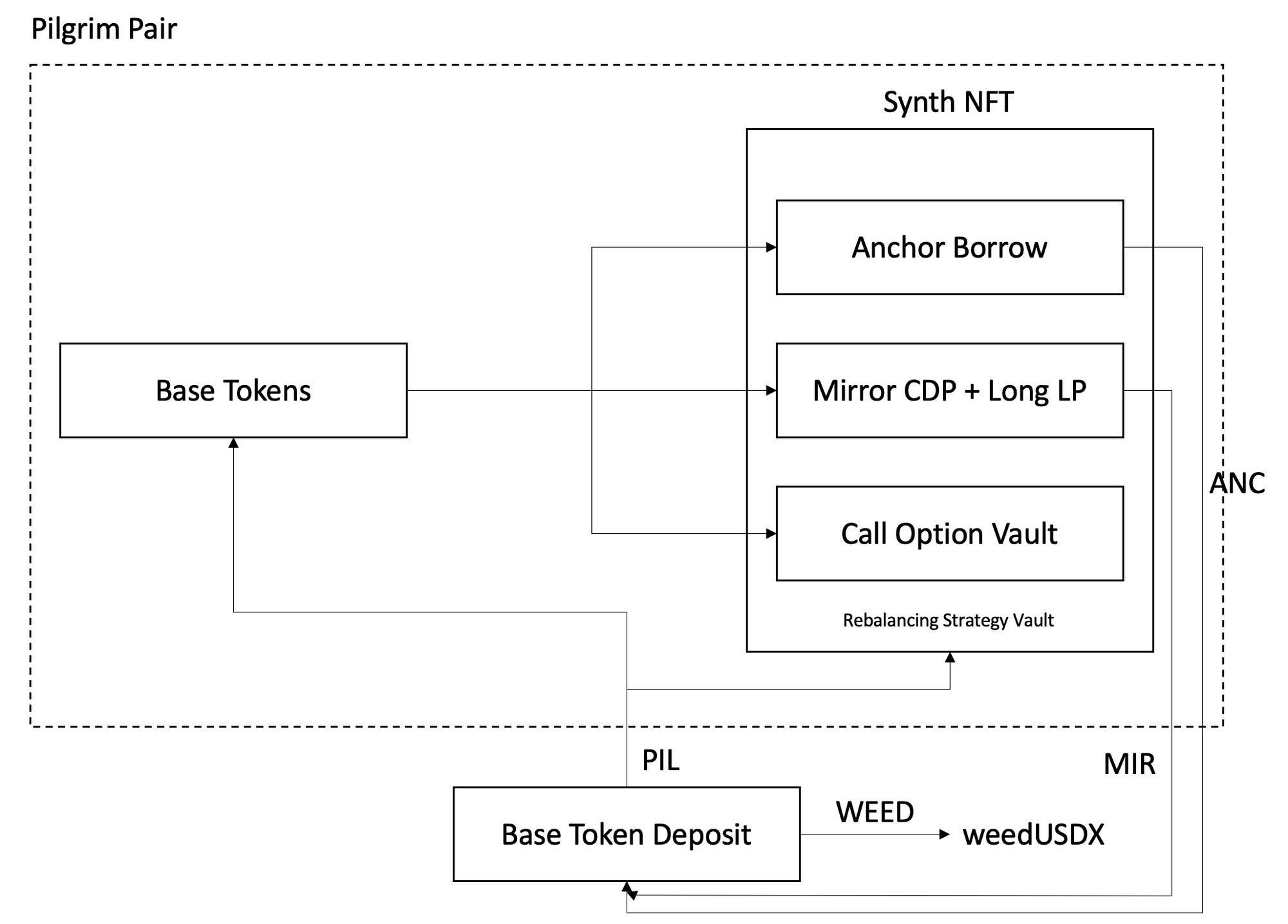

To mitigate this issue, we will introduce a novel concept called nonfungible synthetic assets: synths represented as NFTs.

What does it even mean for a synthetic asset to be nonfungible?

Let's define a base valuation pair for a hedging strategy vault to target its total time-weighted valuation against. Even for the exact same counterposition pair, having ETH as its valuation pair and UST as its valuation pair at a 10% fluctuation margin would result in completely different position rebalancing conditions – as a short for one would be a long for another.

Looking at a bETH-UST Anchor borrow position and UST-mETH Mirror CDP hedge, for instance, we are dealing with two asset types here: ETH and UST. If the base valuation pair for this hedge vault is UST, the vault would actively manage against ETH volatility, and vice versa – even for the same position combination.

If the base pair for a hedge vault is ETH, this is an ETH synth, as the entire position attempts to be pegged to a fixed amount of ETH. For UST, the vault would be a USD synth, both yield-bearing.

Now we have vault NFT synths that are pegged to some fungible asset. How will we trade, hold, and potentially liquidate those synths, though? We obviously do not want those nonfungible vault positions to be our primary stablecoin.

Evil smile time 😈, this is where Pilgrim comes in.

C. Pilgrim Rounds as Fungible Synthetic Assets

Pilgrim can mint fungible valuation positions for hedge vault NFTs.

Rounds for an ETH-base hedge NFT synth would have ETH as its valuation pair, which means that merely buying and holding rounds result in partial yield being generated from the NFT's underlying hedging strategies. Rounds for a UST-base hedge NFT synth would have UST as its valuation pair, which is another stablecoin yield generating strategy.

What's more – they also represent trading liquidity for this particular synth, which is also a hedging position composed of Anchor borrow positions, Mirror CDPs and call option vaults.

Does this remind you of something? Let's go full-on Curve War mode and provide users with that sweet, sweet yield only with Anchor borrow positions.

D. The Big Picture

If autocompounding ANC, MIR, PIL, and WEED rewards combined are large enough to compensate for borrow costs and volatility, then it would make sense for people to organically borrow stablecoins from Anchor.

This brings us back to the concept of hedging capital efficiency: i.e., how much capital is actually at work compared to its utilization ratio. This is also in direct relation with option position volatility – if one position has a gamma value higher than its counterposition, then we would need more capital on the other side to hedge against gamma, which would decrease capital efficiency – and eventually yield.

If we want to create a Yearn-like experience out of this, then rebalancing parameters and mechanisms set with our strategies would have to be way smarter than the one we described above.

I am exploring this concept under the name Weed Protocol.

If no one else is building this, then we will.